🔥TaxDome product updates: explore what’s coming soon and the features you already can enjoy. Learn more

Net profit, also known as net income or the bottom line, is the final amount of profit earned by a business after all expenses have been deducted from its total revenue over a specific period.

It’s a key metric for assessing a company’s financial health and profitability.

Here are the parameters used to calculate net profit:

- Revenue: income generated from the sale of goods or services

- Expenses: costs incurred in running the business, including cost of goods sold (COGS), operating expenses (OpEx), interest, and taxes

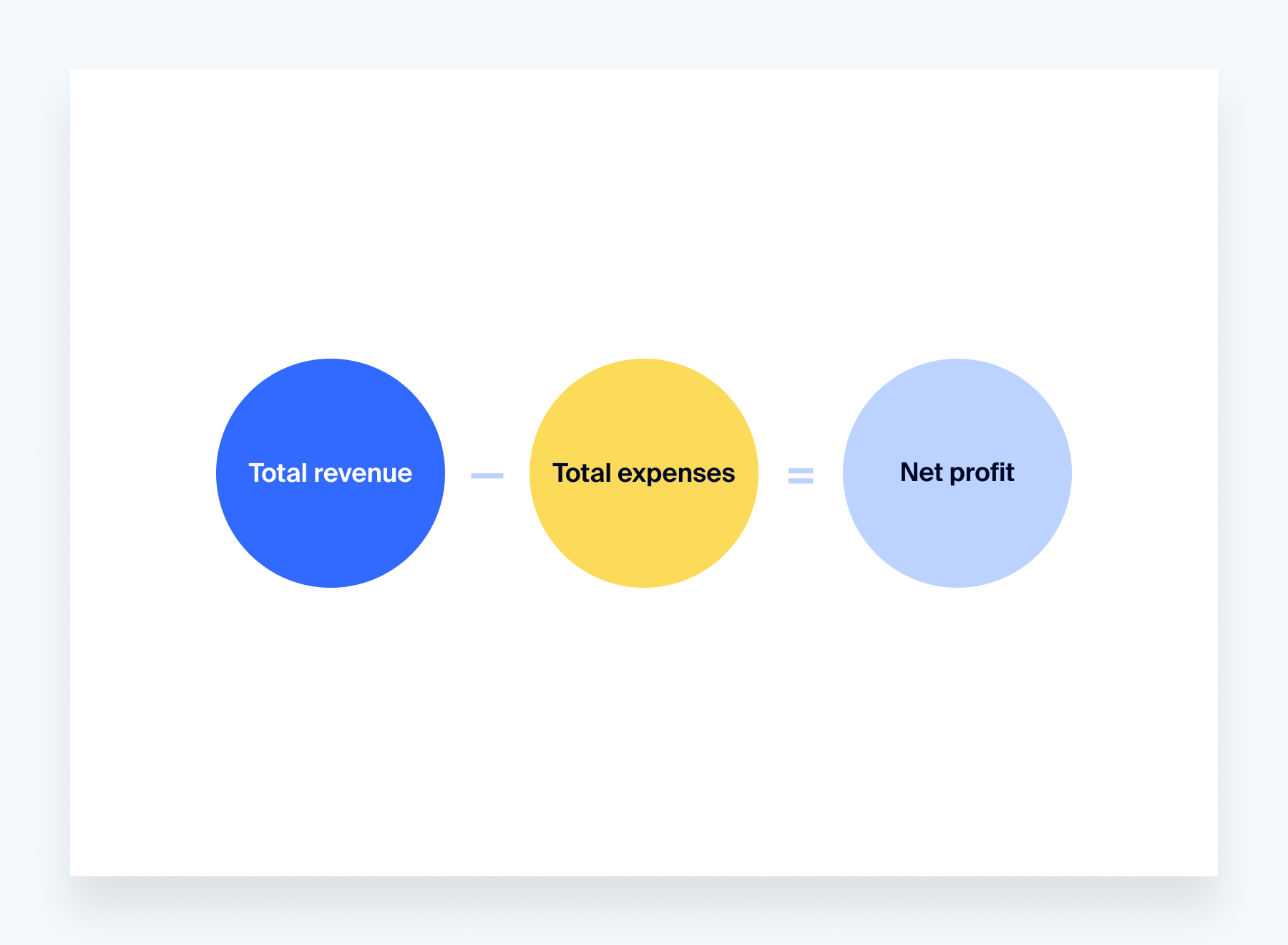

Net profit is calculated by subtracting total expenses from total revenue:

A positive net profit indicates the business is operating profitably, while a negative net profit signifies a net loss.

Frequently asked questions

What’s the difference between net profit and gross profit?

Net profit considers all expenses, including operating expenses, interest, and taxes.

Gross profit represents the profit remaining after deducting the cost of goods sold from revenue, and it doesn’t factor in other operating expenses.

Net profit provides a more comprehensive picture of a company’s profitability, while gross profit offers a measure of efficiency in managing production costs.

How is net profit used by businesses and investors?

Usually, businesses analyze net profit to evaluate financial performance, make budgeting decisions, and assess pricing strategies.

For investors, net profit is used to gauge a company’s profitability and growth potential, supporting investment decisions.

Can net profit be negative?

Yes, net profit can be negative, indicating the business’s expenses exceeded its revenue during the period. Companies might experience net losses during their initial stages or due to economic downturns.