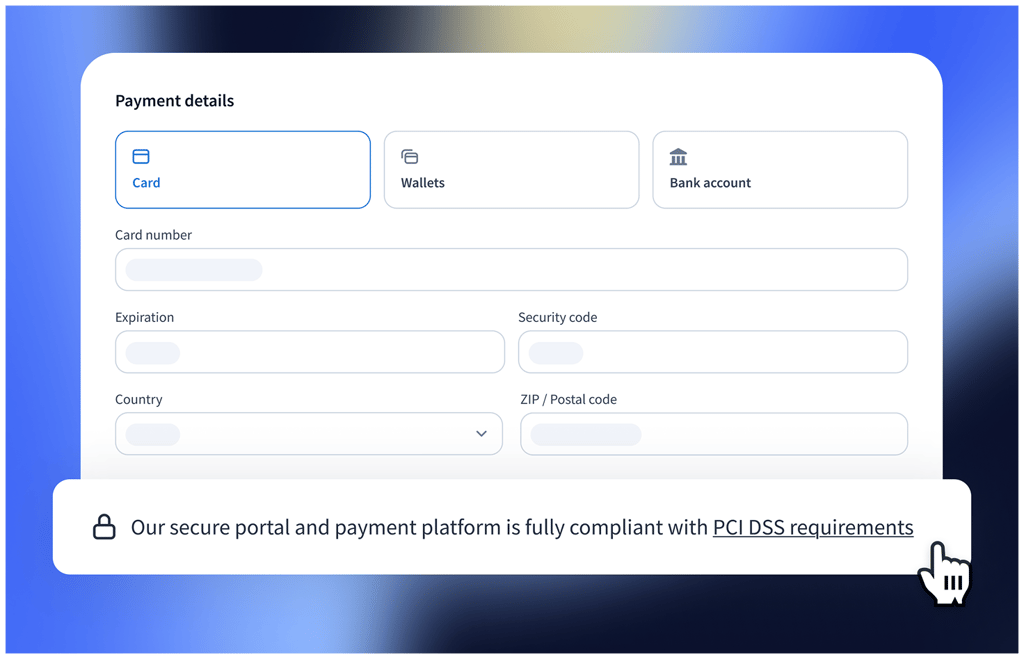

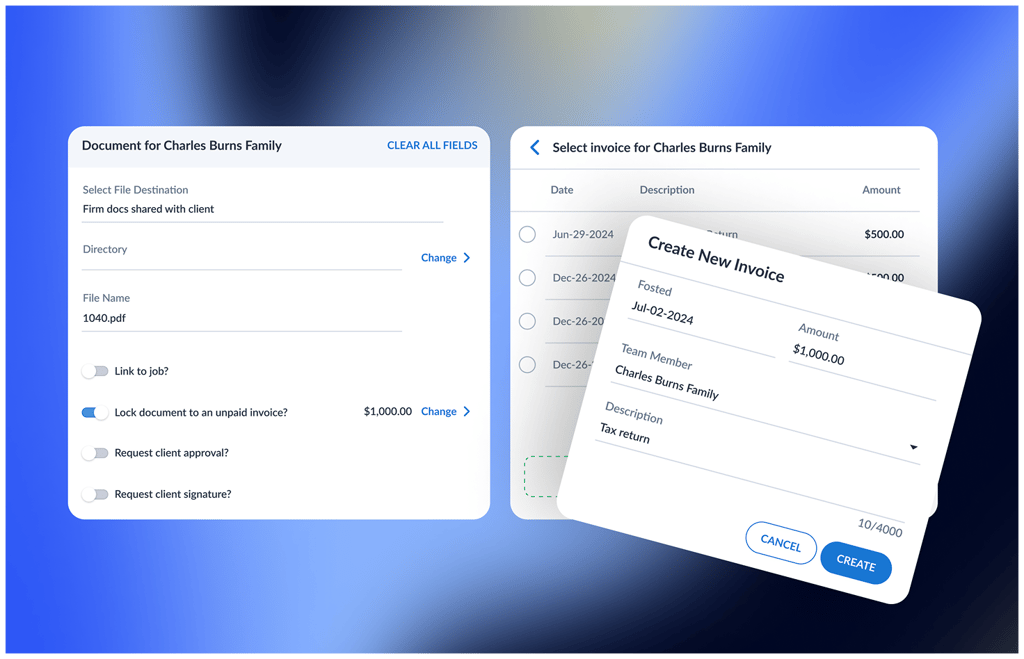

Integrate secure payment processing into your workflow

Winner Comprehensive Firm Workflow Solution

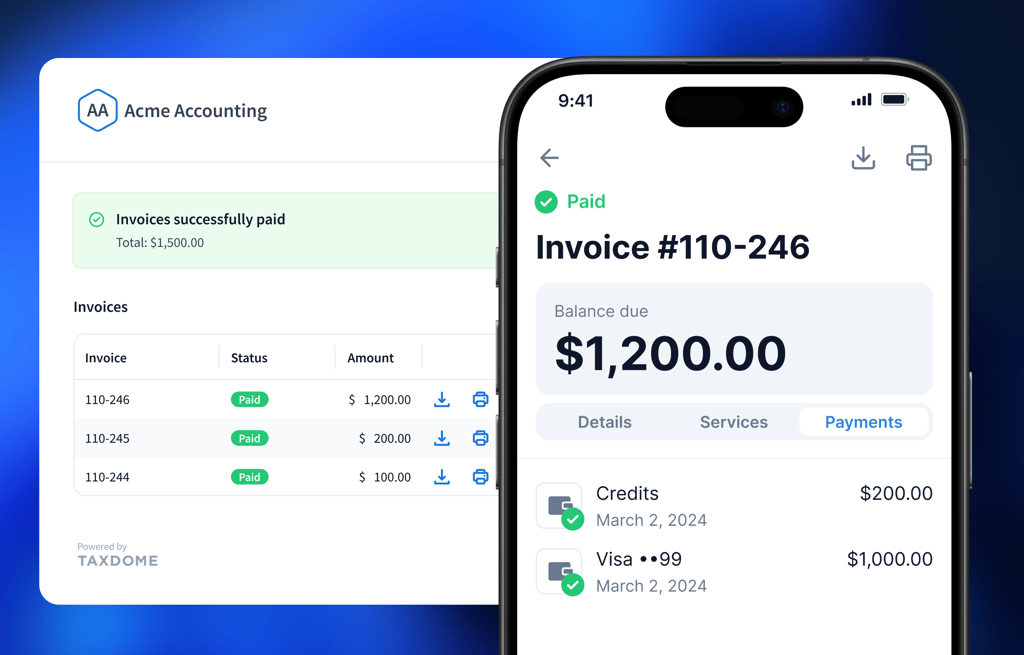

Accept payments with no limits

Accept credit card or bank debits in the USA, Canada, Oceania, and Europe

Accelerate payments

Get paid faster with integrated payment processing

Get your free guide

Thank you!

The guide copy has been sent to your email. Please check your inbox!

Apple Pay

Apple Pay  Google Pay

Google Pay  SEPA

SEPA  ACH payments

ACH payments  BECS

BECS  PADS

PADS